Household Growth in New Orleans Increases over the Past 5 Years

Not only have the New Orleans house prices increased 46% since Hurricane Katrina hit 10 years ago, but the city has also seen a 90% recovery rate. Many believed that the tens of thousands who fled the area after Hurricane Katrina would not return, and this was simply not the case. A report which came out on July 13, 2015, from Data Center shows that between 2010 and 2014, the growth in New Orleans was 12%, making the city 28th in population growth among 714 cities with more than 50,000 people nationwide. The study also indicated there was an additional 1% growth between 2014 and 2015.

In the New Orleans area, households that received mail increased by 19,651 since June 2010, with 65 out of 72 neighborhoods seeing some sort of increase. In general, 40 of the 72 neighborhoods have already recovered 90% of the population pre-Katrina and 16 neighborhoods have actually exceeded their pre-Katrina population.

neighborhoods seeing some sort of increase. In general, 40 of the 72 neighborhoods have already recovered 90% of the population pre-Katrina and 16 neighborhoods have actually exceeded their pre-Katrina population.

The neighborhoods which saw the fastest recovery rate of at least 30% were ironically the most heavily flooded areas. These include households in Filmore, Holy Cross, Lakeview, Lower 9th Ward, Pines Village, Pontchartrain Park and West Lake Forest. Between 2010 and 2014, the areas known as the “sliver by the river”, added 1,355 households in the Central Business District (CBD), 545 households in Treme/Lafitte, 321 households in the Lower Garden District and 297 households in Bywater. Eight neighborhoods have increased by at least 100 households which include the Central Business District (CBD), Central City, St. Roch, Little Woods, Lower 9th Ward, B.W. Cooper, 7th Ward and Treme/Lafitte.

Only four of these neighborhoods have less than 50% pre-Katrina households. These include B.W. Cooper, Florida, Iberville and Lower 9th Ward. Not to worry, B.W. Cooper, Florida and Iberville are housing developments that have mostly been demolished or are being redeveloped so they cannot be considered households until completed. The Lower 9th Ward was the worst damaged from the storm and is making a slower recovery than most. Only seven neighborhoods lost households between 2010 and 2015. Many are relocating to the city of New Orleans “proper” and its surrounding or suburb neighborhoods, placing a great demand on new housing developments. In general, New Orleans is making a great recovery and is holding steady with its population numbers.

Click Here to View the Source of the Information.

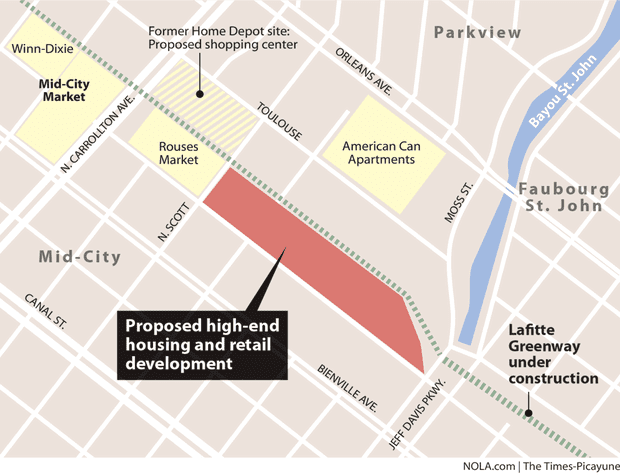

property. Because of its proximity to the new University Medical Center and the Veteran Affairs hospital, housing and retail is being planned as a TND (Traditional Neighborhood Development) to include housing and retail in walking distance within this master-planned community for potential employees of these two medical facilities.

property. Because of its proximity to the new University Medical Center and the Veteran Affairs hospital, housing and retail is being planned as a TND (Traditional Neighborhood Development) to include housing and retail in walking distance within this master-planned community for potential employees of these two medical facilities. drop to sustainable levels.

drop to sustainable levels.